salt tax deduction limit

There is talk that the SALT deduction limit will be. The new proposal from the Democrats raises.

Trump Open To Changing Salt Deduction Cap In New Tax Code

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

. The law included a cap of 10000 not inflation adjusted for state and local taxes SALT such as state and local income and real property taxes. What is the SALT deduction limit. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break.

Individual taxpayers who itemize their. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. Previously the deduction was unlimited.

52 rows As of 2019 the maximum SALT deduction is 10000. Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions.

The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. Second is New Jerseys longstanding 10000 cap on deducting. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and.

Supreme Court has rejected a challenge to overturn the 10000 limit on the federal deduction for state and local taxes which is known as SALT. The 10000 limitation is the same for single. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. Starting with the 2018 tax year the deduction was limited to 10000. The first is the new 10000 limitation on deducting state and local taxes also called SALT on your federal income tax return.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. Lets break down how it impacts taxpayers. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

The SALT Deduction Post-Reform The TCJA limited the SALT deduction available to individual taxpayers. This means you can deduct no more than. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

Theres now a cap on your SALT deduction The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and. This deduction is a below-the-line tax. The change may be significant for filers who itemize deductions in high-tax.

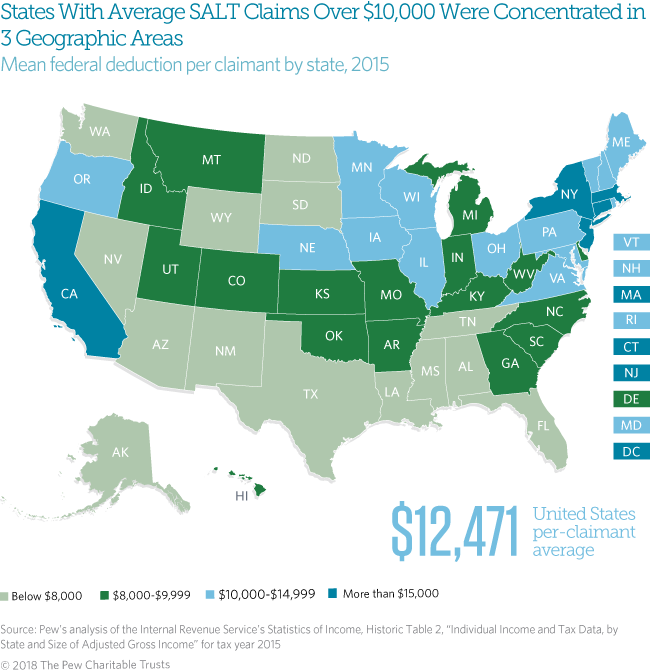

To be impacted by the limit 3. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on. The Tax Cuts and Jobs Act TCJA limited the amount an individual can deduct from the amount of the following state and local taxes they.

These States Offer A Workaround For The Salt Deduction Limit

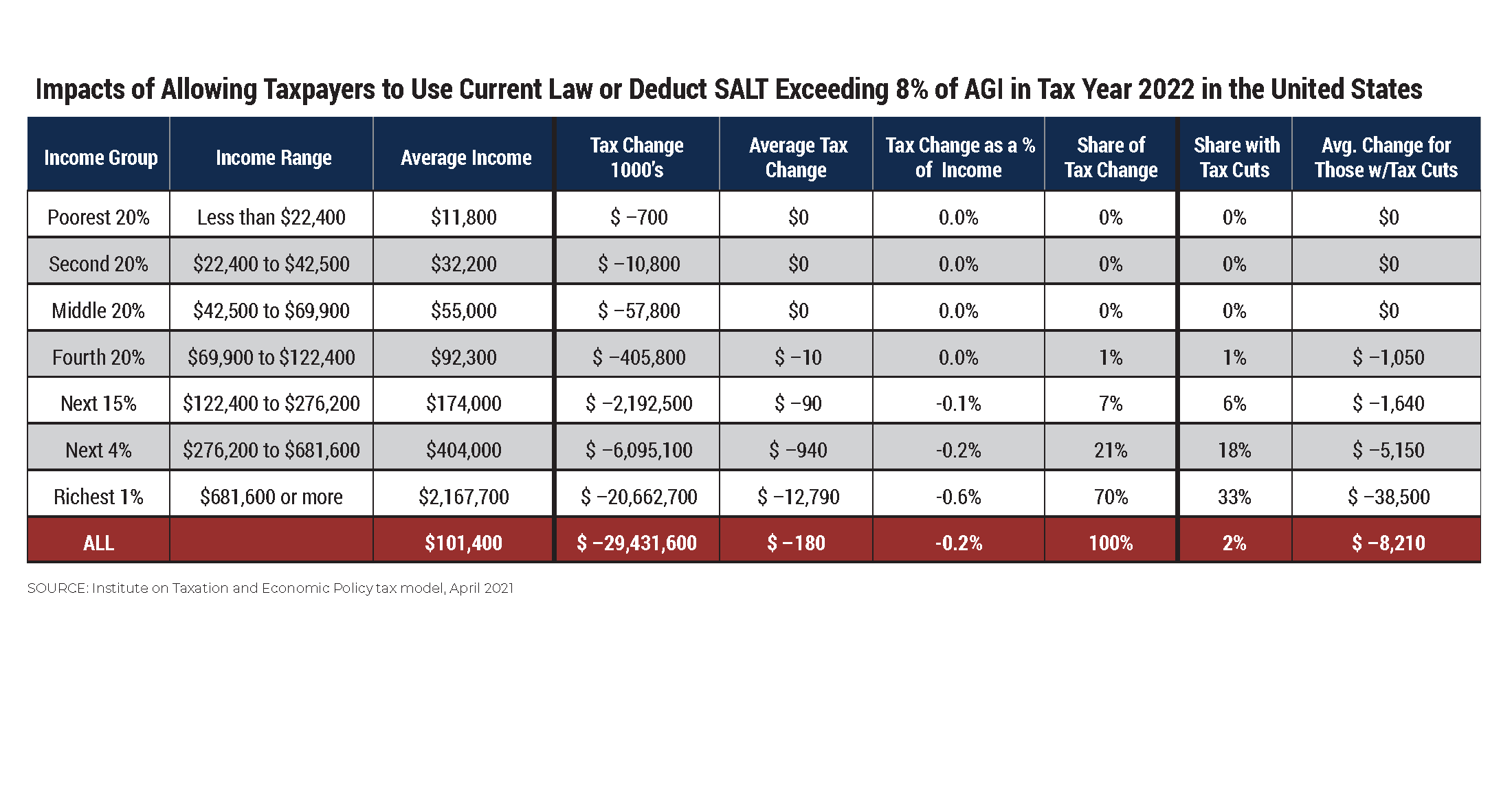

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Changes To Federal Salt Deduction Expose Illinois High Taxes

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Shaking Up Your Salt Deductions Jmf

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

House Democrats Push For Salt Relief In Appropriations Bill

Salt Cap Repeal Salt Deduction And Who Benefits From It

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Finally A Solution To The Limits On State And Local Tax Deductions Morningstar

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts